Human Med

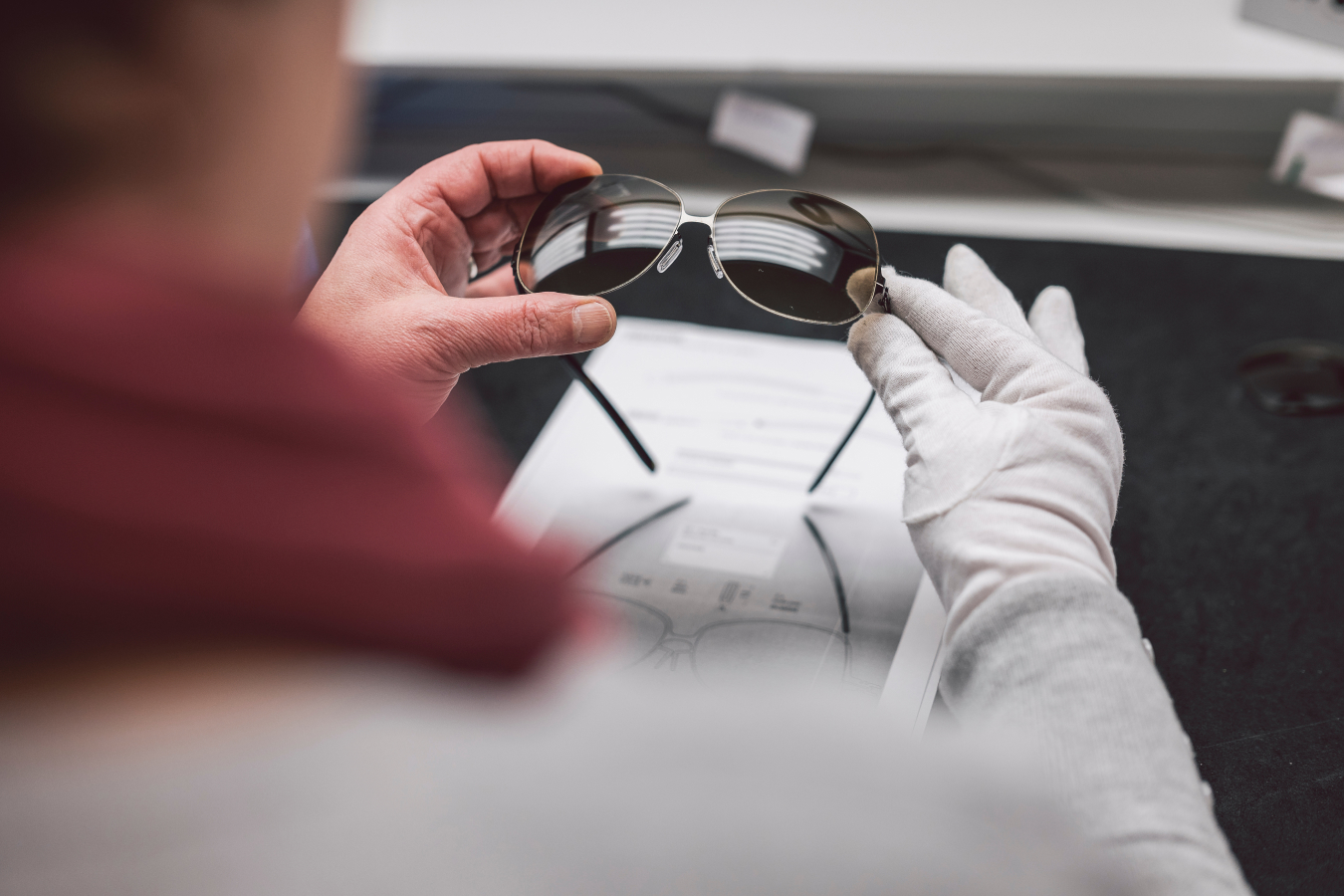

Mit patentierten Technologien und Produkten im Bereich der ästhetischen und regenerativen Medizin ist die Human Med AG ein marktführendes Unternehmen für die Behandlung von Fettverteilungsstörungen in einer Branche mit sehr großem Wachstumspotenzial. Ihre patentierte WAL-Technologie (Wasserstrahl-assistierte Liposuktion) zählt zur schonendsten Art der Lipödem-Behandlung. Human Med ist auch das technologisch führende Unternehmen weltweit für die Gewinnung von autologem Fett. Das innovative Verfahren eignet sich für zahlreiche Folgeanwendungen (Brustrekonstruktion, Wundbehandlung etc.), in denen Eigenfett wieder zum Einsatz kommt.

Healthcare

+ MedTech

Sektor

MBO

Beteiligungsanlass

Medizin-

Technologie

Branche

Seit

2022

Beteiligungszeitraum

Beteiligungsvorgehen

Die strategischen Prioritäten wurden zu Anfang der Beteiligung festgelegt. Neben einem Ausbau der Marktführerschaft ist es das Ziel, die Wachstumspotenziale der Human Med AG – in bestehenden Märkten und aufgrund neuer Anwendungsgebiete in der regenerativen Medizin in neuen Märkten – weiter zu fördern. PREMIUM ist Mehrheitseigentümer.

Strategische und operationelle Maßnahmen

Expansion in neue medizinische Anwendungsbereiche

Fokussierung des Vertriebs und Marketings auf die wichtigsten Märkte und Kundengruppen

Ausbau der Organisation und der Kapazitäten als Voraussetzung für die Realisierung hoher Wachstumspotenziale

Meilensteine der Unternehmensentwicklung

Lösung der Nachfolge durch einen neuen Buy-in-CEO

Komplettierung des Managementteams

„Human Med ermöglicht mit innovativen Technologien die effektive und schonende Behandlung von Lipödemen und anderen gesundheitlichen Themen, die bisher nur unzureichend behandelt wurden. Die regenerative Medizin ist ein wichtiges Zukunftsfeld der Medizin.“

Möchten Sie mehr erfahren?

Berthold Hackl

AR-Vorsitzender und Operating Partner